Hi, my name is Brad Bullard and I'm an account executive at SuretyBonds.com. As a new business owner, it is likely you'll have to purchase a surety bond to complete the business licensing process. Today, I'm going to break down specific bond information, application requirements, cost expectations, and logistics involved in receiving your bond. Now let's get started. Before a motor vehicle dealer's license can be issued or renewed by the Texas Department of Highway Safety and Motor Vehicles, the dealer must purchase a surety bond from a provider authorized to work in the state. The bond must then be filed with the DMV. Both independent and franchise motor vehicle dealers are required to post a $25,000 surety bond with the state of Texas. These bonds are issued on a two-year term and must start on the first of a month. If you have any questions, the DMV can help you determine the exact bond type you will need for your business license. Then, you're ready to apply for your bond. Our application is incredibly quick and easy. Your personal account manager will walk you through the process step-by-step over the phone and should only take five minutes in most cases. If it's before or after the hours you see on your screen, you can always submit a quote request online to jumpstart the process. The next available account manager will call you as soon as possible the following day to finalize your application. Once your application has been submitted, our underwriting team will review it for pricing. We generally return quotes within one business day, but oftentimes, customers will receive their quotes within an hour or two of their submission depending largely on credit score. The lowest rates for the Texas Motor Vehicle dealer bond start at just $306 for the state...

Award-winning PDF software

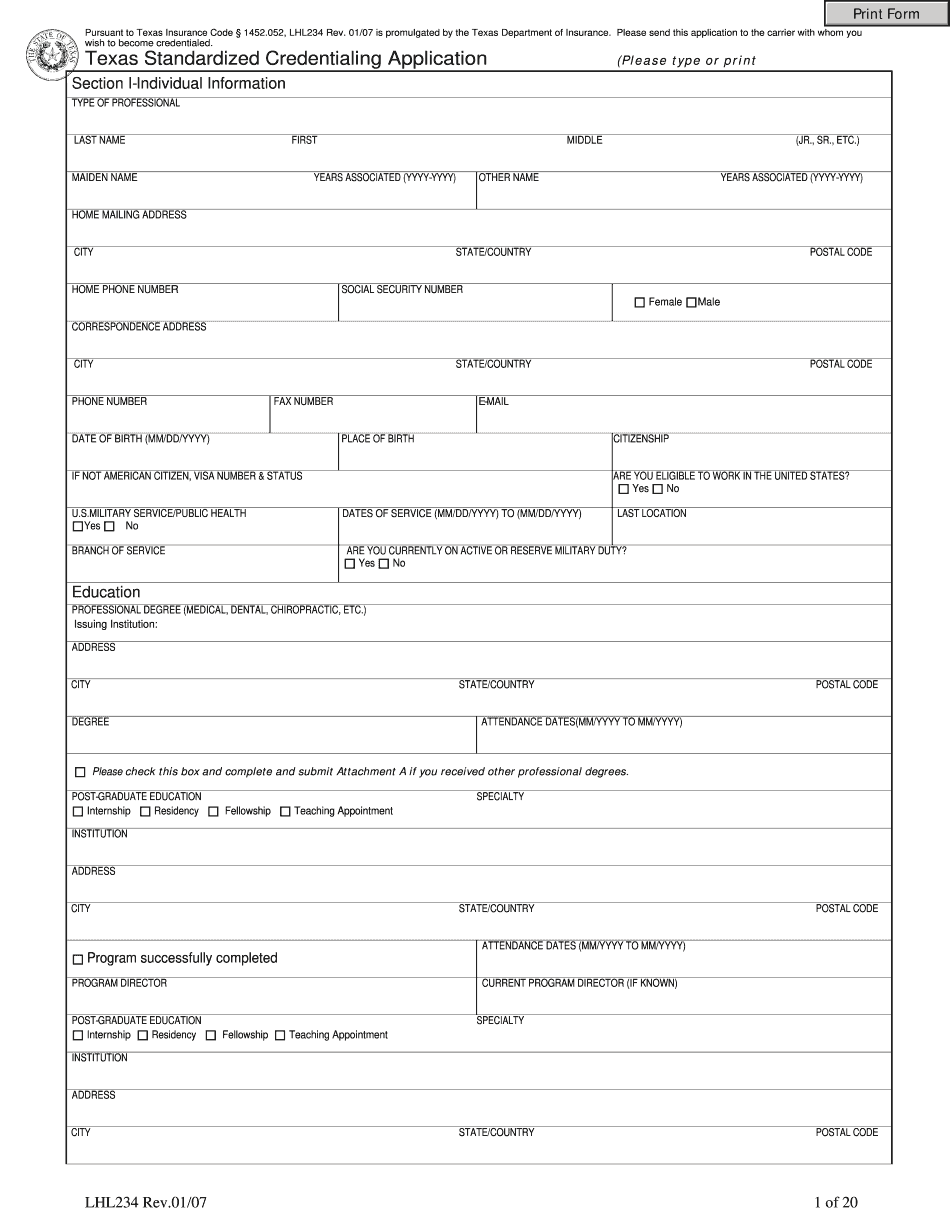

How to fill out Texas Standardized Credentialing Application Form: What You Should Know

Fill in Required information as follows. You will send documents directly to our office (not a copy of them) for filing electronically. Choose a Signature. If needed, sign. Select the document you want to sign and click Upload. You will need to provide the document number when you upload it. You will be able to print online, or fill in the document with fill and fax it. Follow the steps below to upload your documents. Click Upload and you will be provided an email to our office to complete an online application. The confirmation email will contain the following link: Select the document you want to sign and click Upload. You will need to download and fill the PDF Document to upload to your PC (not a copy of it) and attach the PDF Document to your application. Make sure the document name is correct. Ensure the document contains information on you and your professional credentials. If you filled in the form but never filled in the Credentialing Information, it will be automatically entered. Follow the steps below to fill in your application. Choose the field where you need your credential. Provide the required information on your professional background. Select a signature. Review and update all information at your discretion. Texas Standardized Credentialing Application — Fill Online Incorporating Additional Documentation You can submit additional documents to help us verify you are eligible to receive a Texas standard credentialing exam and credential. Your documents should be provided as a single PDF document. To provide more than one document on this page on a single machine. Please use the file type drop down or the download button. Additional Documentation — minnow This step is only necessary when you have additional documents provided to us. Please fill this step out completely to assist us in the process. Additional Document — minnow For more information about adding documents to your application, click on Adding Documents to Your Application — minnow All documents are valid for 10 years. When you receive the documents, please read the instructions given to you. You will be able to print from your PC, iPad, tablet or mobile device after your document has been filled out.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do TX Tdi Lhl234, steer clear of blunders along with furnish it in a timely manner:

How to complete any TX Tdi Lhl234 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your TX Tdi Lhl234 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your TX Tdi Lhl234 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to fill out Texas Standardized Credentialing Application