Upon the roof, it's peaceful as can be, unless you need to get it replaced. Let's just admit it, you're hoping for a hailstorm so insurance will cover it. So let's talk about following a roof claim and avoid hitting the ceiling. The standard home policy has replacement cost coverage for your roof. That means the policy pays - the deductible, what it costs to replace your roof. But as insurers have had to replace more and more roofs, they've started tightening up on those coverages. We're now seeing more actual cash value coverage, which deducts for wear and tear. So before you buy an insurance policy, make sure you discuss roof coverages. It can make a big difference in your insurance payment. For example, let's say it costs $20,000 to replace your 10-year-old roof after hail damage, and your home policy has a $3,000 deductible. A policy with replacement cost will pay $17,000, that's the $20,000 - the $3,000 deductible. A policy with actual cash value coverage will take into account the age of your roof. This is usually done with a depreciation schedule. For instance, if the value of your roof had depreciated by half after 10 years, this policy would pay $7,000. That's the $20,000 cost cut in half, so $10,000 - the $3,000 deductible. If you do have replacement cost coverage, you'll probably get the payment in two checks. One after your insurance company agrees to pay for the damage and the second after you replace your roof. Now, you need a roofer. Trust me, you want to take your time to find a roofer. Before you sign the contract, ask for recommendations, post something on the neighborhood app, give the neighbor down the road, Mrs. Crabb, something to write about other than that annoying cat....

Award-winning PDF software

Tdi insurance Form: What You Should Know

This form is for the TDI, Group Life/Accidental Death & Dismemberment (ADD) and Life (including Group Life/Accidental Death & Dismemberment (ADD)) Disability Insurance. This form should be completed before any benefit is paid. Please also provide all of your information and contact information. (If you choose to claim a TDI, you will be required to provide your social security or work records to support your claims. Please indicate on Form TDI-15.pdf, if you have filed an accident / injury claim within the last 5 years, in one or more statements, and in the case of a TDI claim received within the last 5 months, a short summary of those events in your Form TDI-15.pdf, please note if you received TDI insurance for your employer as of Jan 1, 2014.) (If you choose to claim a TDI, you will be required to provide your social security or work records to support your claims. Please indicate on Form TDI-15.pdf, if you have filed an accident / injury claim within the last 5 years, in one or more statements, and in the case of a TDI claim received within the last 5 months, a short summary of those events in your Form TDI-15.pdf, please note if you received TDI insurance for your employer as of Jan 1, 2014.) Form TDI-15.pdf — TDI Insurance Claim & Statement — Filing Instructions. Form TDI-15.pdf — TDI Insurance Claim & Statement — Filing Instructions. “This form was issued pursuant to Chapter 32, Occupations Code, which says that only a statement is required in order to file an accident / injury claim. This statement must include all the details required to establish that the claimant is entitled to TDI. We appreciate that employers are reluctant to allow employees to receive benefits. As an employer, I feel that it has become necessary to fill out this form to show that I will support all my employees who want coverage for injury and illness.” — Roger S.

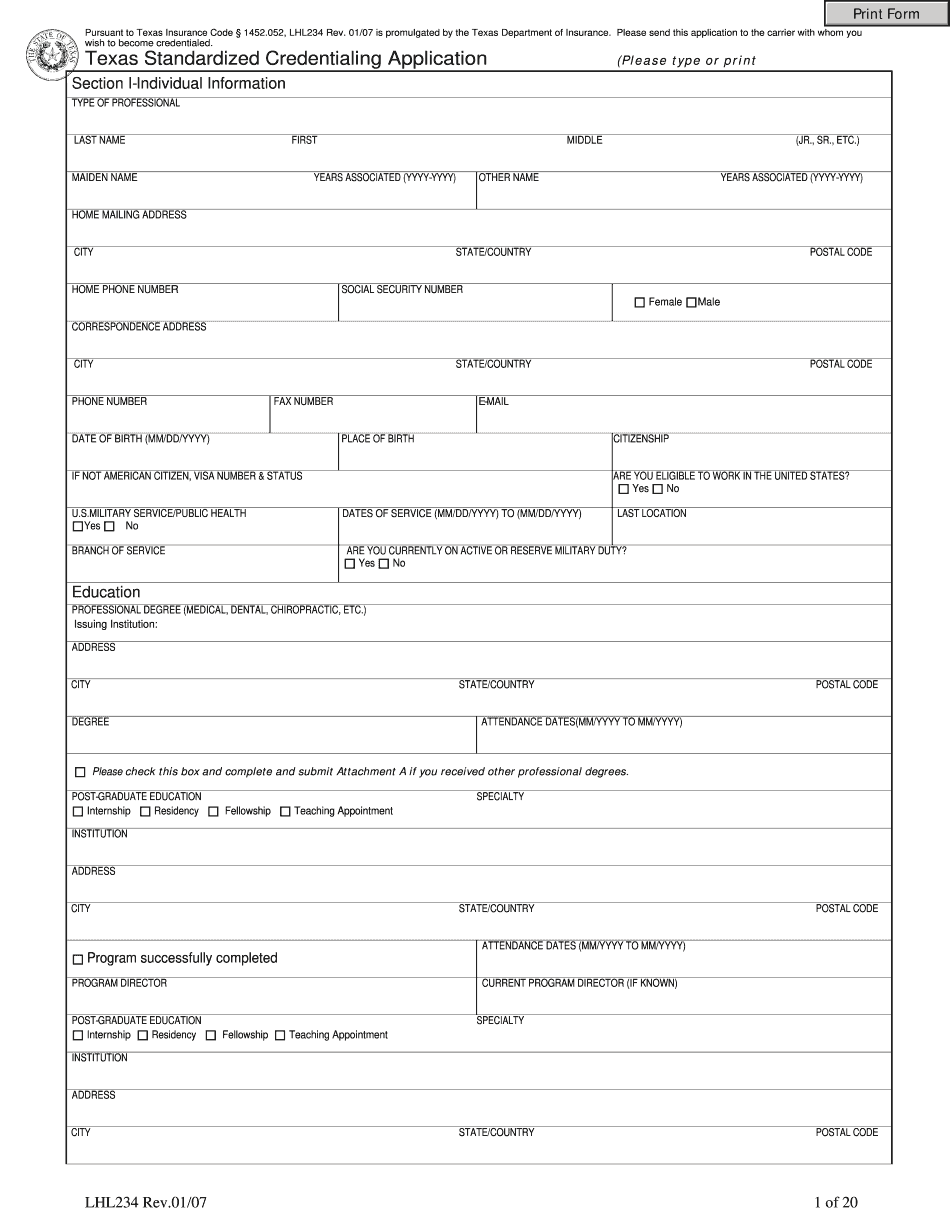

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do TX Tdi Lhl234, steer clear of blunders along with furnish it in a timely manner:

How to complete any TX Tdi Lhl234 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your TX Tdi Lhl234 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your TX Tdi Lhl234 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tdi insurance