Music seniors can be targets of insurance fraud, especially involving life and health policies. Older adults may worry about becoming a burden to their families if they don't have sufficient coverage, and scammers take advantage of these concerns. - Here are five ways to prevent senior fraud: 1. Beware of agents who contact you without any prior solicitation. They probably obtained your information from a mailing list. While not all agents who reach out to you are dishonest, it's wise to be cautious. If possible, meet the agent in person rather than purchasing insurance over the phone or online. Take the information home and review it in detail. 2. Watch out for high-pressure sales tactics, such as warnings of a last chance deal or attempts to appeal to your emotions. Take your time and consider consulting with your family or an accountant. Involving more family and friends decreases the likelihood of falling victim to fraud. 3. Be extremely cautious if an agent urges you to cash in an annuity or life insurance policy to purchase a new one. These policies typically gain more value the longer you hold onto them. Ensure any changes are made in your best interest and not solely for the agent's commission. 4. Exercise caution regarding agents who claim to represent Medicare, Social Security, or any other government agency. The government does not sell insurance, so agents posing as government officials are breaking the law. To report suspected fraud or verify an agent's legitimacy, contact the Texas Department of Insurance Consumer Health line at 1-800-252-3439. Note: The content has been divided into sentences. There were some minor grammatical corrections made for clarity.

Award-winning PDF software

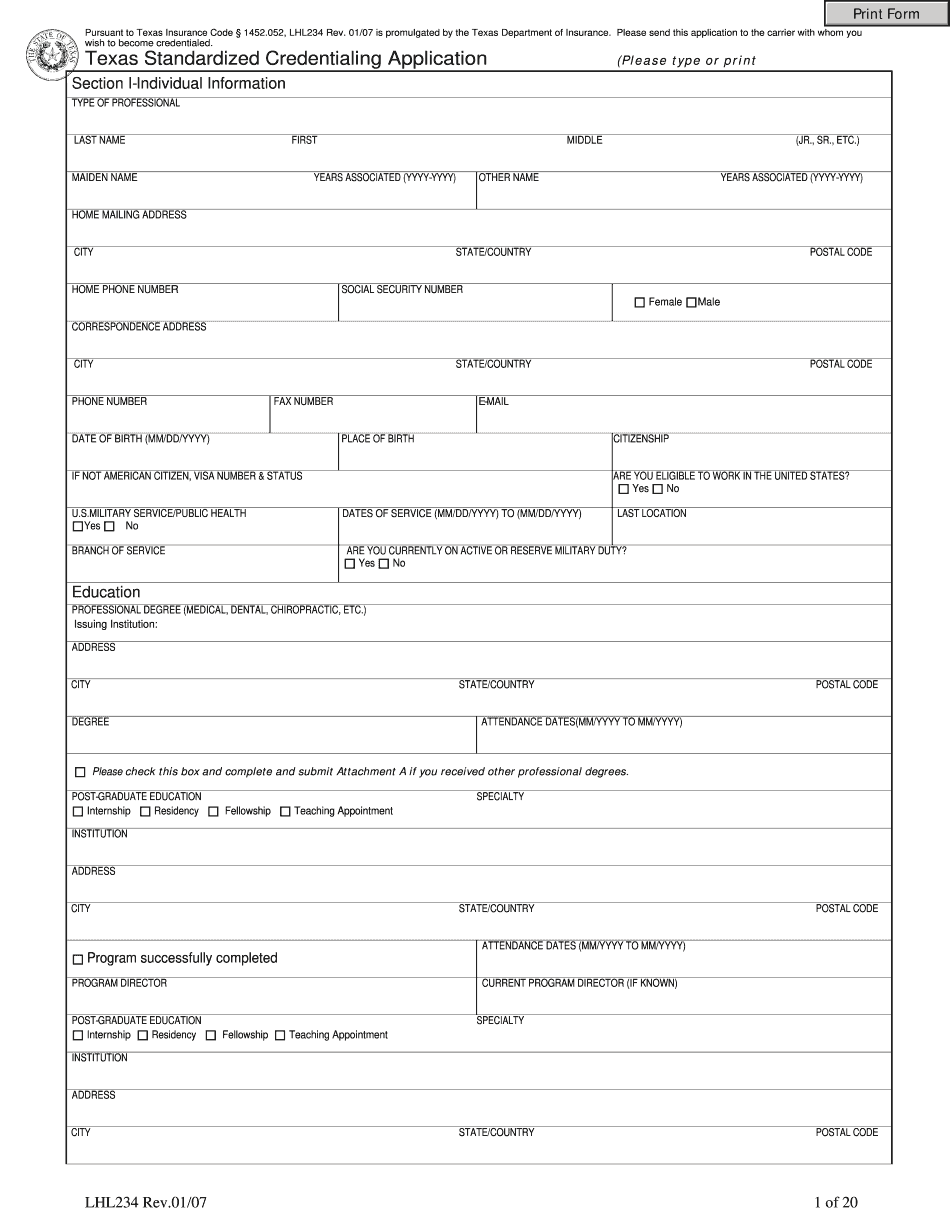

Texas department of insurance phone number Form: What You Should Know

The following are a list of frequently requested forms. If you have additional question on how to contact TDI, please email.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do TX Tdi Lhl234, steer clear of blunders along with furnish it in a timely manner:

How to complete any TX Tdi Lhl234 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your TX Tdi Lhl234 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your TX Tdi Lhl234 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Texas department of insurance phone number