Award-winning PDF software

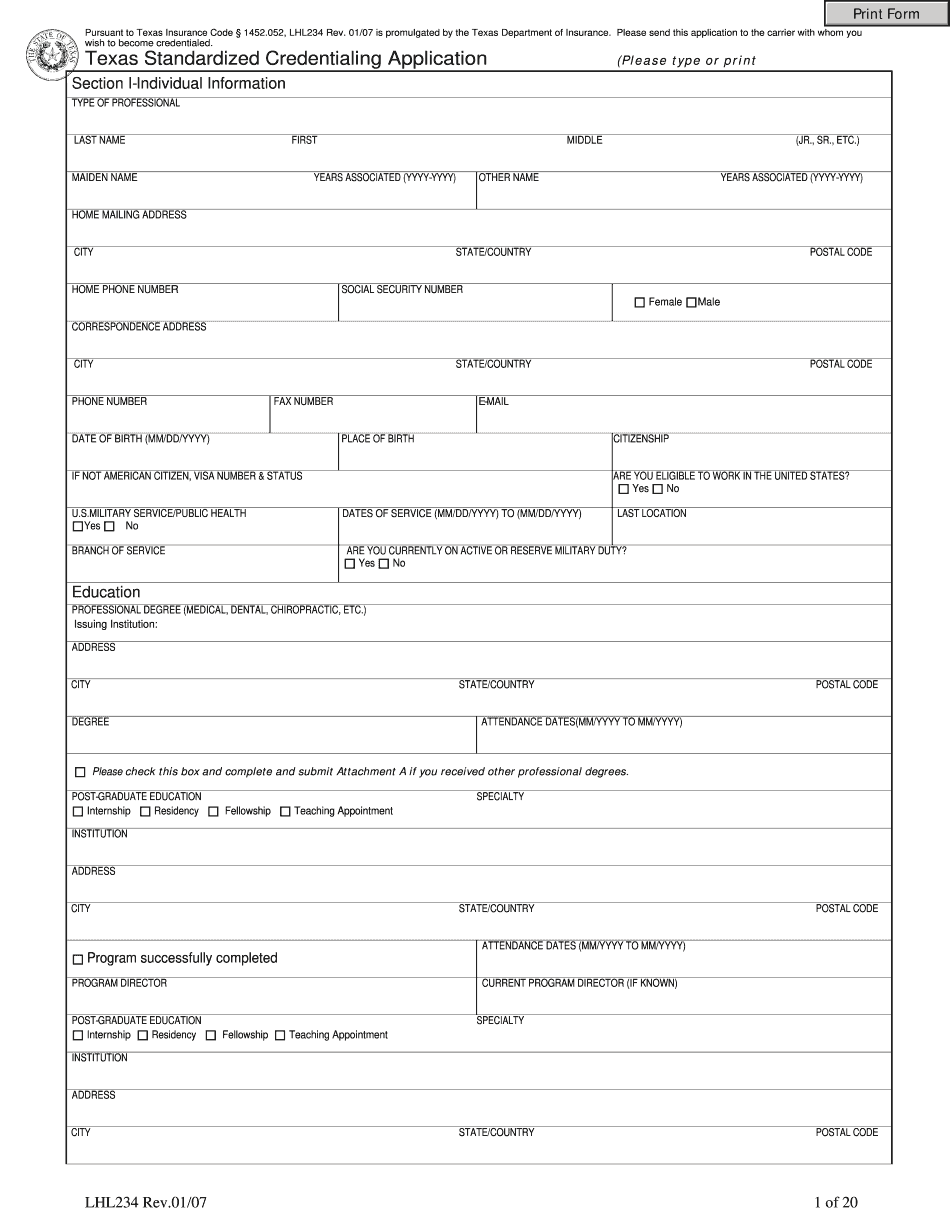

Texas Department Of Insurance - Formalu: What You Should Know

Texas Motor Insurance, Section 11.04, 11.06, 12.04,12.06, 13.04, 14.04, 15.04, 16.04, 32.06; 33.04;34.04; 35.04, 36.04; 36.06, 37.04; 37.06, 42.04; 42.06, 44.04; 44.06, 46.12, 46.40, 46.40C, 46.64, 46.66, 48.04, 48.04C, 48.10, 58.04, 58.08, 66.04, 66.04C, 66.08, 66.14, 66.20, 66.24; 67.04; 68.04; 68.15; 69.04, 68.20, 68.28, 68.31, 68.32; 68.34; 68.36; 68.37; 68.38, 69.04 Policies Up To And Including Basic PremiumPolicies Up To And IncludingBasic Premium10,00023932,50040010,50025233,00040011,00024335,500405 Texas Motor Insurance, Section 32.04T Jul 24, 2025 — Texas Motor Vehicle License Title Insurance Policy; Texas Motor Insurance The Texas Motor Vehicle License Title Insurance Policy forms the basis of all other personal and commercial liability insurance and auto rental liability coverage policies. The form must be filed for purposes of coverage and benefits under all of these policies. TEXAS TITLE INSURANCE POLICY AND TEMPORARY LICENSE COVERAGE Policies Up To And IncludingBasic Premium 2,50025,000 2,50032,500 2,50049,500 2,50069,500 2,50089,500 5,00039,500 2,50069,5005,00095,500 Basic Manual Of Title Insurance, Section III Jul 24, 2025 — Texas Title Basic Manual 3 — Section III Rate Rules. The Schedule of Basic Premium Rates for Title Insurance shall apply to all policies filed and accepted after September 1, 2015. Texas Motor Insurance, Section 11.06, 12.04, 14.04, 15.04, 16.04, 32.06; 33.

Online methods assist you to to arrange your document management and strengthen the efficiency of the workflow. Adhere to the short manual so as to complete Texas Department of Insurance - Formalu, stay clear of glitches and furnish it inside a well timed manner:

How to finish a Texas Department of Insurance - Formalu online:

- On the web site using the sort, click on Get started Now and pass with the editor.

- Use the clues to fill out the pertinent fields.

- Include your individual info and speak to details.

- Make confident that you enter proper material and figures in acceptable fields.

- Carefully check out the content material in the sort also as grammar and spelling.

- Refer to help you part should you have any problems or address our Support staff.

- Put an electronic signature on your own Texas Department of Insurance - Formalu aided by the help of Sign Instrument.

- Once the form is accomplished, push Performed.

- Distribute the prepared sort by using electronic mail or fax, print it out or help save in your unit.

PDF editor will allow you to make adjustments towards your Texas Department of Insurance - Formalu from any online world linked machine, personalize it according to your preferences, indicator it electronically and distribute in various approaches.